How to Manage your Debt? and Reduce It Effectively in 7 Steps

1. Take Stock of Your Finances

How to manage your Debt?

Firstly, start by listing all debts, noting interest rates. Identify strains and prioritize repayment.

2. Verify Your Credit Report

Ensure accuracy; check for forgotten debts. Also get a free credit score assessment from your bank.

3. Explore Consolidation Options

Consider combining not only high-interest loans but also obtaining a low-interest personal loan.

4. Assess Your Spending

Subsequently evaluate monthly expenses, cut back where possible to prevent additional debt.

5. Calculate Monthly Payments

After consolidation, determine total monthly payments, adjust budget accordingly.

6. Allocate Extra Funds

Identify discretionary money in your budget for additional debt reduction.

7. Choose Your Strategy

Select a debt reduction strategy based on personal preferences for optimal results.

Q&A Section:

How does consolidation impact federal loan forgiveness?

Review terms; because consolidation may affect eligibility for federal loan forgiveness.

Advantages of paying high-interest balances first?

Also prioritize high-interest balances for long-term savings and quicker progress.

Why check your credit report regularly?

Although ensure awareness of debts and maintain a healthy financial profile.

How to manage your Debt? Tips for Effective Debt Management

- Always Pay on Time

- Timely payments contribute significantly to a positive credit score.

- Timely payments contribute significantly to a positive credit score.

- Monitor Your Credit Regularly

- Particularly review credit reports regularly for accuracy at annualcreditreport.com.

- Particularly review credit reports regularly for accuracy at annualcreditreport.com.

- Pay More Than the Minimum

- Accelerate debt reduction thus minimize interest, and potentially boost credit score.

- Accelerate debt reduction thus minimize interest, and potentially boost credit score.

- Know Your Limits

- Keep revolving credit balances under 30% of the limit for a positive credit score.

- Keep revolving credit balances under 30% of the limit for a positive credit score.

- Maintain a Healthy Debt-to-Income (DTI) Ratio

- Although Aim for a DTI ratio below 35% to enhance creditworthiness.

- Although Aim for a DTI ratio below 35% to enhance creditworthiness.

- Take on New Debt Wisely

- Apply for credit judiciously; also avoid unnecessary accounts to maintain a good credit score.

- Apply for credit judiciously; also avoid unnecessary accounts to maintain a good credit score.

- Qualify for Lower Rates

- Explore not only lower rates with improved credit but also with dropped interest rates.

- Explore not only lower rates with improved credit but also with dropped interest rates.

- Think Before Closing Accounts

- Closing accounts may temporarily hurt credit scores; thus consider the impact.

- Closing accounts may temporarily hurt credit scores; thus consider the impact.

- Build an Emergency Fund

- Subsequently, have savings to avoid reliance on credit cards for unexpected expenses.

- Subsequently, have savings to avoid reliance on credit cards for unexpected expenses.

Need Help? Contact the National Foundation for Credit Counseling (NFCC) for personalized financial counseling.

Explore Different Ways to Pay Down Debt

- Lower monthly payments

- Pay off debt faster

- Compare debt paydown strategies

Products to Consider:

- Personal loan

- Mortgage refinance

- Balance transfer

Before applying, meanwhile carefully evaluate whether consolidating existing debt is the right choice.

Q&A Section:

How to calculate DTI?

Divide monthly debt payments by gross monthly income.

How to refinance debt?

Indeed explore options with Wells Fargo or other institutions for rates and terms aligned with financial goals.

Best way to consolidate debt?

Weigh benefits and drawbacks; thus consider if it aligns with overall debt reduction goals.

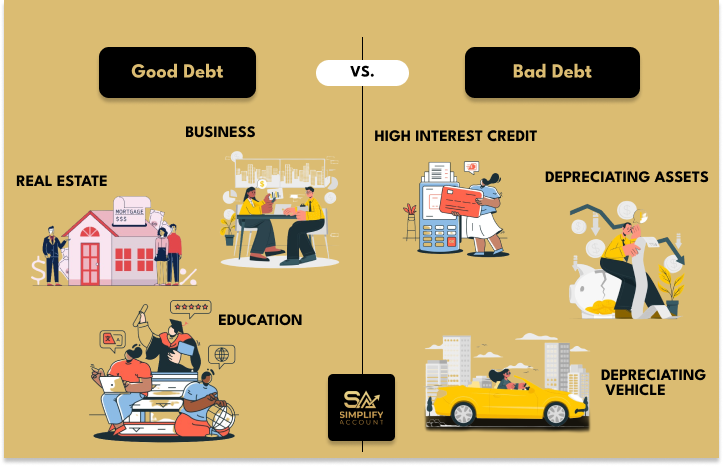

How to manage your Debt? Understanding Good Debt vs. Bad Debt

Overview: Firstly, distinguish between good and bad debt for informed financial decisions. Then explore debt’s impact on wealth-building and effective management strategies.

What Is Good Debt?

- Education: Invest in future earning potential.

- Business Ventures: Debt for a successful business is a worthwhile investment.

- Real Estate: A mortgage for a home can build equity and offer tax advantages.

What Is Bad Debt?

- Consumables: High-interest credit for everyday expenses.

- Depreciating Assets: Financing rapidly depreciating assets is not financially prudent.

- Cars: Going into debt for a rapidly depreciating vehicle is generally not advisable.

Managing Debt Effectively

- Budgeting: Develop a comprehensive budget.

- Debt Prioritization: Allocate extra funds toward high-interest debts.

- Debt Consolidation: Explore options for faster repayment.

FAQs:

- Examples of ‘Good Debt’?

- Education, business ventures, and real estate investments.

- Examples of ‘Bad Debt’?

- High-interest loans for consumables or depreciating assets.

- What Is Debt Management?

- Planning and organizing debt repayments for financial stability.

The Bottom Line:

Therefore, distinguish between good and bad debt, consult a financial advisor, and also explore effective debt management strategies for a secure financial future.

Explore about Debtor Management and its importance.